Wednesday, April 1st—today's news: Donald Trump warns the coronavirus death toll in the US may reach 100,000. Dividends in Europe will fall 40% according to Barclays, stock markets had their worst quarter since 1987. EUR/USD is at 1.0931, GBP/USD—1.0931; Brent oil is $21.67 per barrel, gold is $1,595.57. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

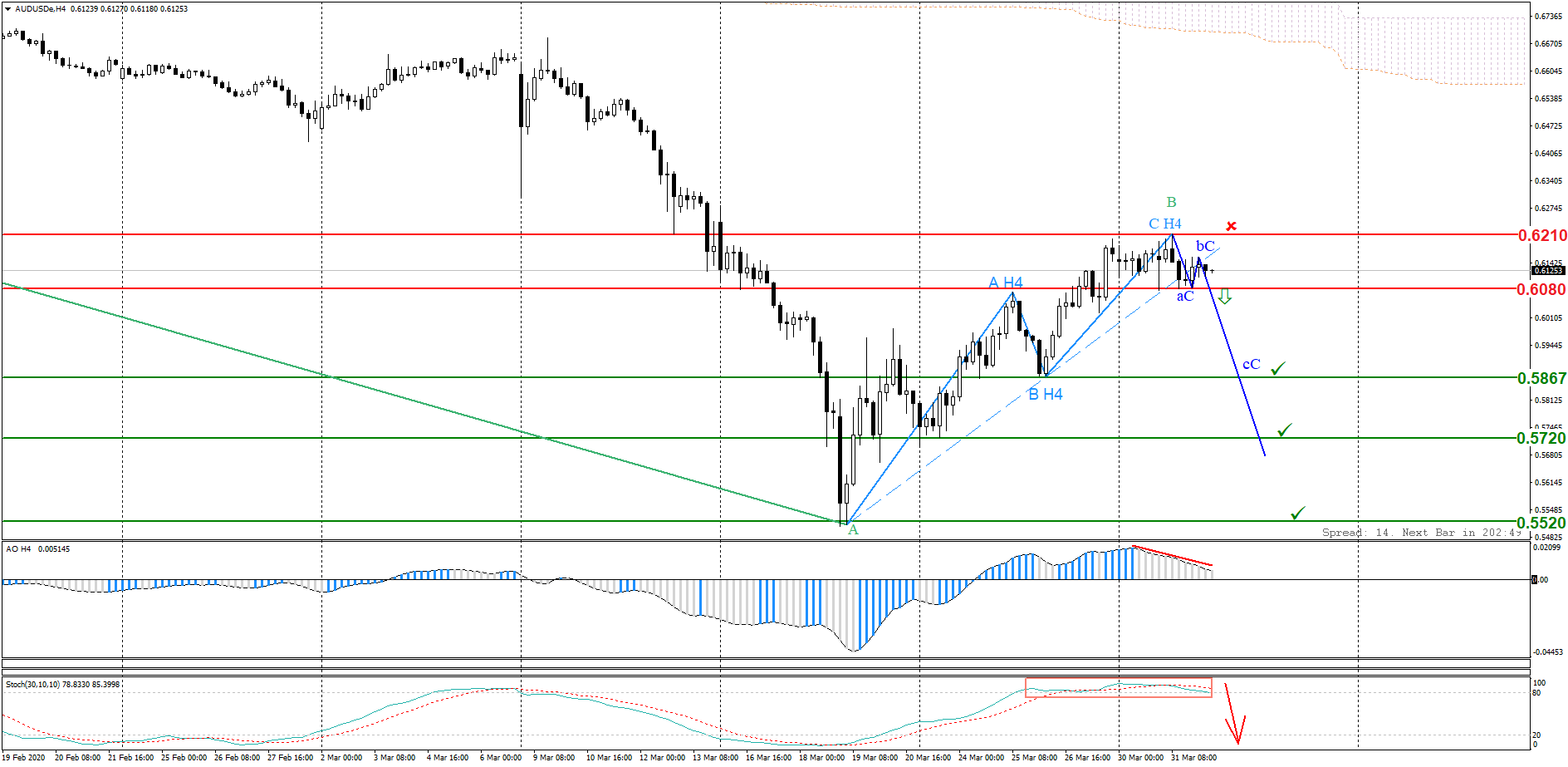

The overall trend is downward. The 0.6210 resistance level is holding back buyers. The ascending H4 level pattern ended with a breakout of the inclined channel. Awesome Oscillator shows bearish divergence, while Stochastic Oscillator signals overboughtness. Breaking through the support level of 0.6080 will result in the formation of a descending pattern within the wave C of the overall downtrend. Keep track of the rate changes in real time.

Trading recommendations: sell below 0.6080 (while a descending wave pattern is forming); stop loss at 0.6210; target levels: 0.5867, 0.5720, 0.5520.

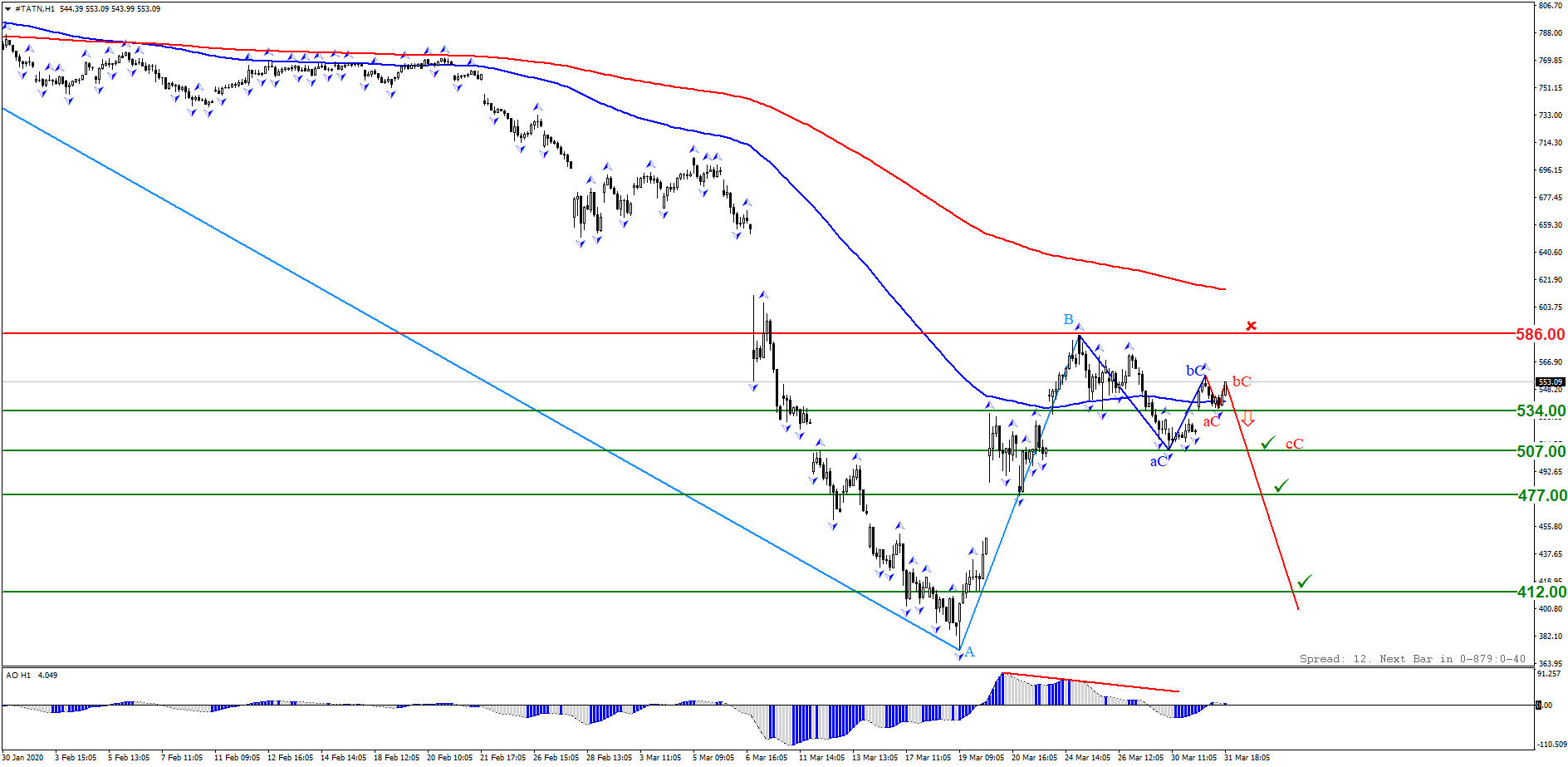

Oil prices continue to update the lows, and the problem is no longer in the inability or unwillingness of the OPEC+ countries to agree on a reduction in oil production, but in the low demand due to the global quarantine measures in response to the COVID-19 pandemic outbreak. Keep track of the rate changes in real time.

Trading recommendations: sell below 534.00; stop loss: 586.00; target levels: 507.00, 477.00, 412.00.

The COVID-19 situation forces investors to exercise caution, which is expressed in limited purchases and sales of assets. The factor of uncertainty still hangs over the markets. The expected extremely weak US employment data from ADP today and from the Department of Labor on Friday puts pressure on the pair and on the demand for risk assets in general. Keep track of the rate changes in real time.

Trading recommendations: sell the pair after its decline below 0.6080 with a likely local target of 0.5945.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.