Tuesday, April 14th—today's news: the crisis in the US markets hasn't peaked yet, Mobius experts say. India extends the nation-wide lockdown, European markets trade higher on the pandemic optimism. EUR/USD is at 1.0928, GBP/USD—1.2565; Brent oil is $28.97 per barrel, gold is $1,720.72. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The pair received support at 107.50. It has every chance to turn up amid the growth of cautious optimism due to decreasing number of coronavirus death in Europe and the US, as well as positive economic statistics from China published today. This may serve as a basis for local growth of the pair. Keep track of the rate changes in real time.

Trading recommendations: buy the pair with its likely growth to 109.20.

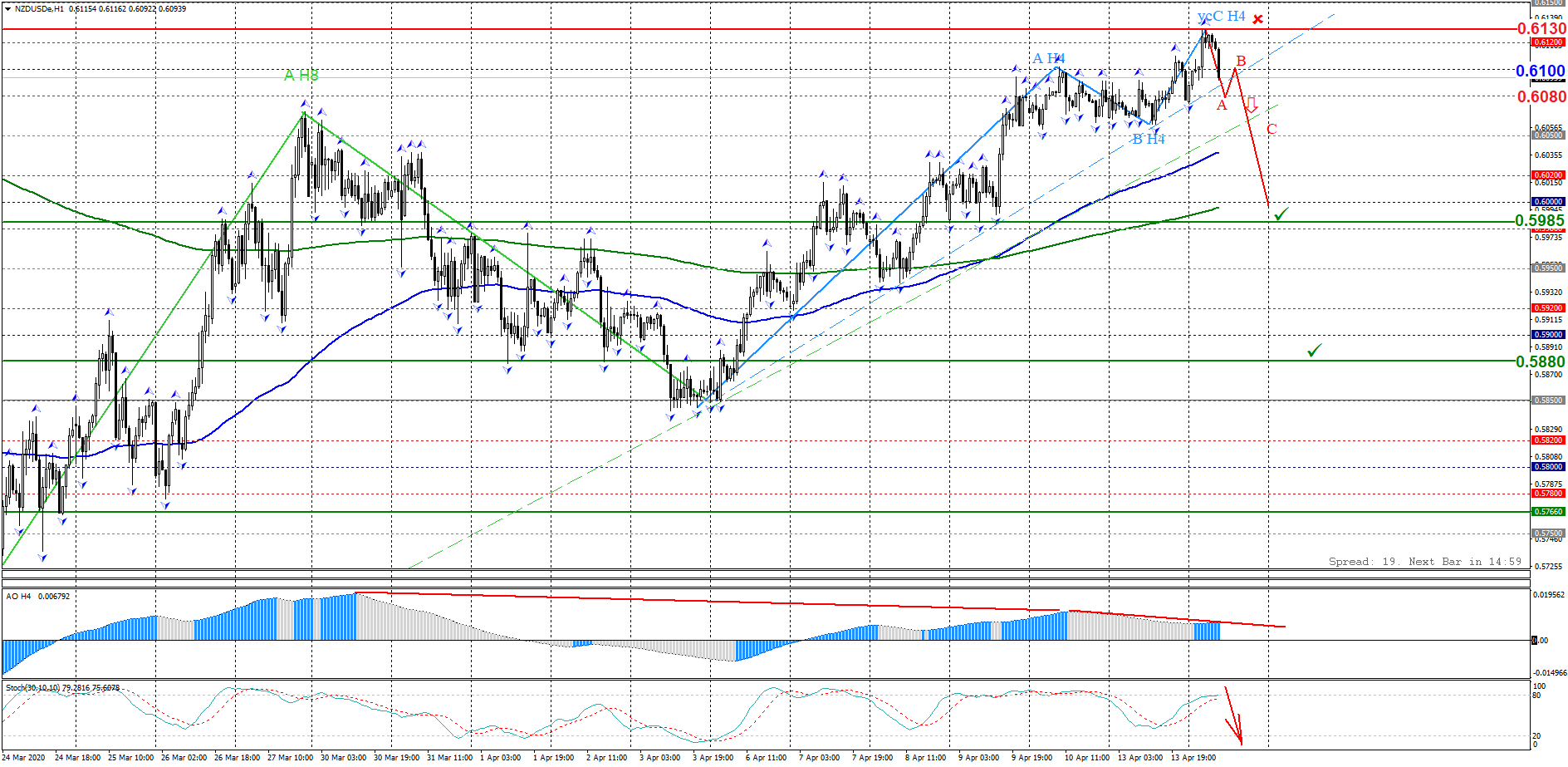

The currency pair is trading in the range of the round important level 0.6100. The ascending patterns of H8 and H4 are truncated. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals overboughtness. The correction of the price below the round secondary level of 0.6080 will result in the breaking through the inclined channel of the ascending truncated H4 level pattern. Keep track of the rate changes in real time.

Trading recommendations: sell while the downward pattern is forming strictly below the round background level 0.6080.

The overall trend is downward. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals overboughtness. A breakout of 574.50 will result in the formation of a 1-2-3 descending pattern within the overall downtrend. Keep track of the rate changes in real time.

Trading recommendations: sell below 574.50; stop loss: 622.90; target levels: 534.00, 477.00.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.