Tuesday, April 21st—today's news: WTI crude oil futures for May delivery goes negative, Brent down 10%. European markets fall amid the oil crash, Germany cancels Oktoberfest over the coronavirus. EUR/USD is at 1.0842, GBP/USD—1.2393; Brent oil is $20.84 per barrel, gold is $1 709,65. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The price pivot zone of 151.00 holds back buyers. Stochastic Oscillator signals overboughtness. The inclined channel of the ascending pattern is broken by the formation of a descending 1-2-3 pattern. Keep track of the rate changes in real time.

Trading recommendations: sell below 143.00; stop loss: 151.00; target levels: 131.00, 123.00.

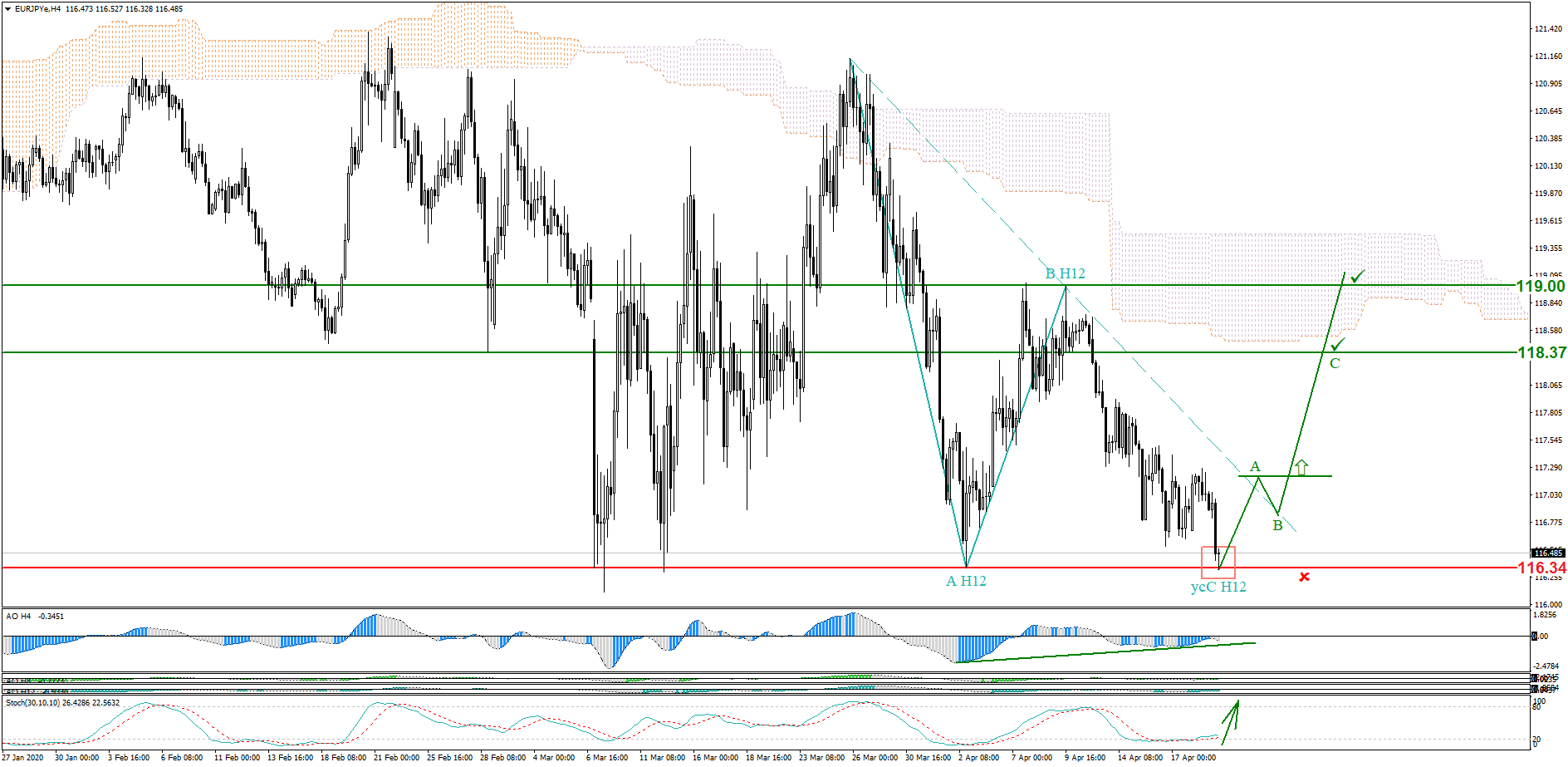

The support level of 116.34 holds back sellers (a false breakout has formed). The descending H12 level pattern is truncated. A bullish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy while an ascending wave pattern is forming, where the wave (A) breaks through the inclined channel of the descending truncated pattern.

The pair consolidates above 1.0825 in anticipation of the new ZEW economic sentiment index for the eurozone and Germany. Negative values caused by chaos in the European Union due to the coronavirus impact can lead to a new local drop in the price. Keep track of the rate changes in real time.

Trading recommendations: sell the pair after it crosses 1.0825 with a likely local target of 1.0770.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.