Monday, May 18th—today's news: European markets gain amid the reopening economies and positive corporate news. The US Federal Reserve predicts an over 30% drop in GBP, Dow Jones rose almost 300 points. EUR/USD is at 1.0803, GBP/USD—1.2111; Brent oil is $34.10 per barrel, gold is $1,769.95. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

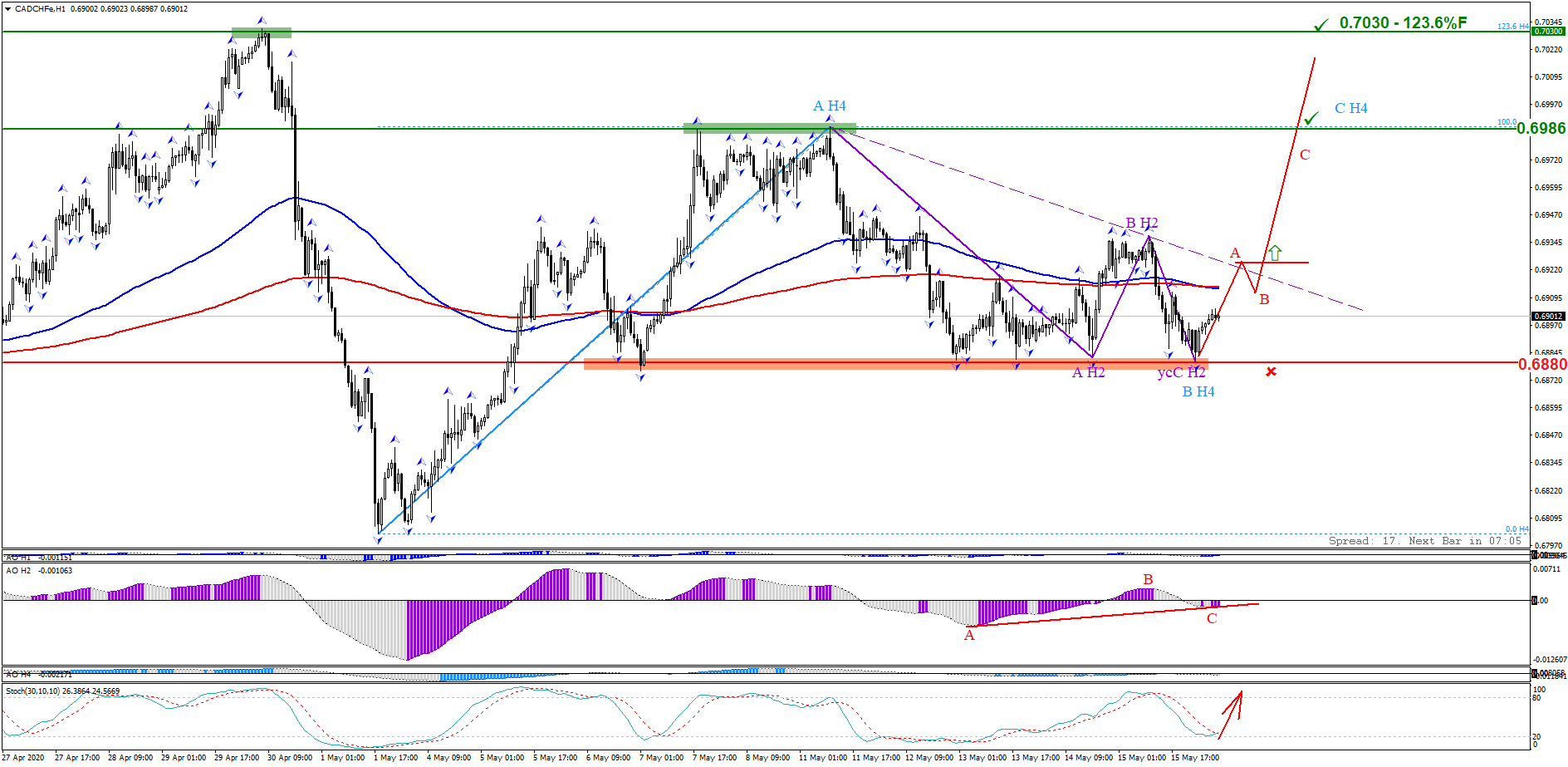

The 0.6880 support level is holding back sellers. A truncated descending H2 level pattern has formed. Awesome Oscillator shows a bullish divergence, while Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy when an ascending wave pattern is formed, where the wave (A) breaks through the inclined channel of the descending truncated pattern.

The support level of 183.50 held back sellers. The stock is trading in the range of a descending price channel. Bullish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy while an ascending 1-2-3 pattern is forming, strictly on the breakout of the upper border of the descending price channel.

The pair will continue to decline after the upward correction. It’s caused by the renewed Brexit tensions that had temporarily subsided due to the coronavirus pandemic. The issues that remain unresolved will put pressure on the pair in the short term amid the pandemic-stricken economy. Keep track of the rate changes in real time.

Trading recommendations: a pullback up to 1.2160 is possible. If it does not rise above this level, it will begin to decline again and will plummet towards the target level of 1.1000.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.