Friday, May 15th—today's news: Germany's economy experiences the sharpest contraction since the Great Recession. White House considers a second round of stimulus checks, Asian markets trade lower amid the escalating US-China trade tensions. EUR/USD is at 1.0815, GBP/USD—1.2202; Brent oil is $31.88 per barrel, gold is $1,744.05. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

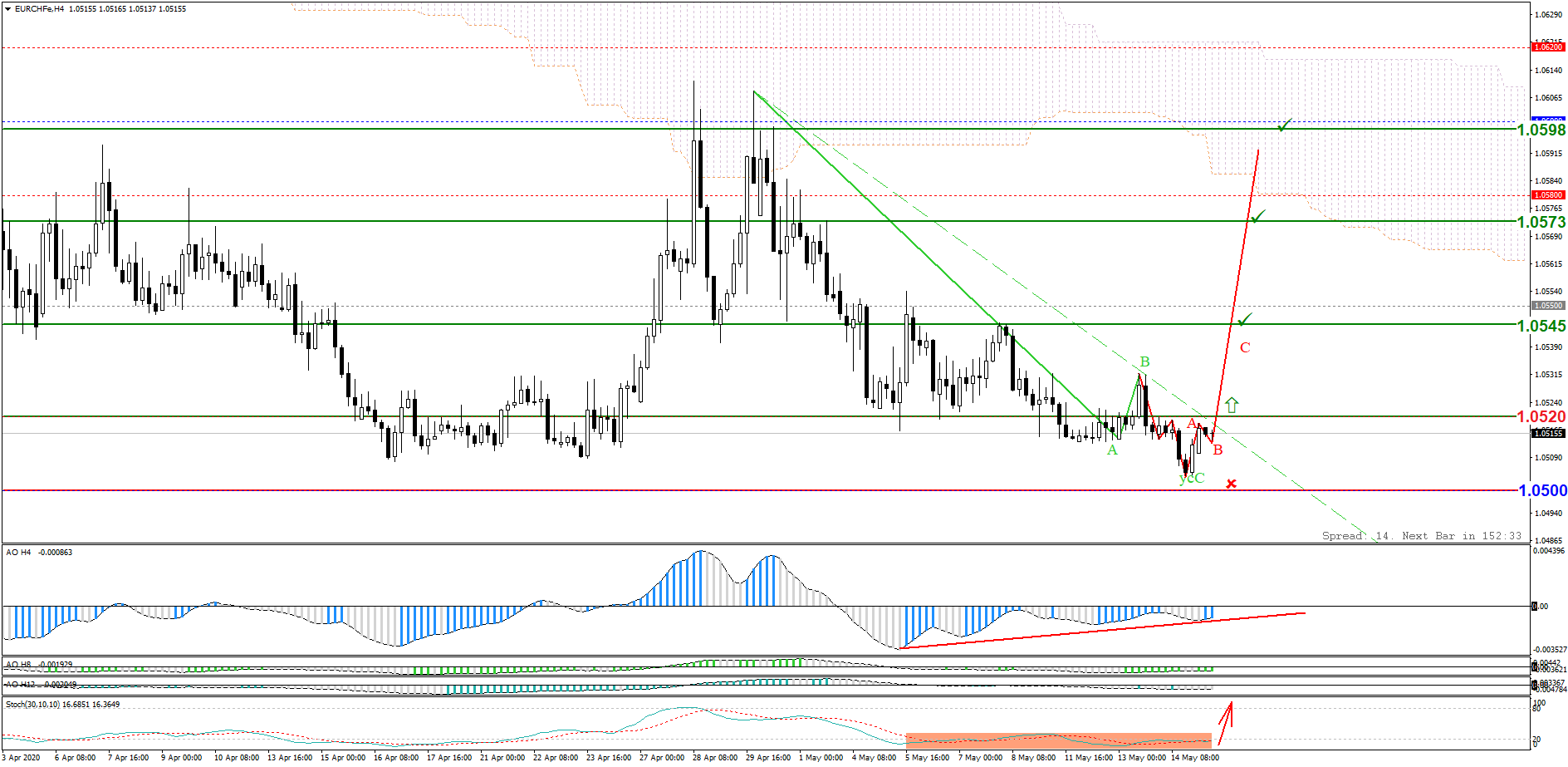

A reversal candlestick pattern has formed: inverted head-and-shoulders. The currency pair is trading in the range of the round important 1.0500 level. Awesome Oscillator shows a bullish divergence, while Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy above the round secondary level of 1.0520; stop loss: 1.0500; target levels: 1.0545, 1.0573, 1.0598.

The pair has formed an ascending flag trend continuation pattern. It’s likely to continue to decline amid the Germany-EU dispute over the massive stimulus measures, which may either lead to a euro oversupply in the European financial system due to massive asset purchases by the ECB, or endanger the very existence of the monetary union. Keep track of the rate changes in real time.

Trading recommendations: expect the pair to continue to decline to 1.0725.

The support level of 183.50 held back sellers. The stock is trading in the range of the lower border of a descending price channel. Bullish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy while an ascending 1-2-3 pattern is forming, strictly on the breakout of the upper border of the descending price channel.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.