Tuesday, May 12th—today's news: Saudi Arabia pledges further production cuts to support oil prices. German court rules that ECB's stimulus measures are illegal under the country's law, some Asian countries experience a new coronavirus outbreak. EUR/USD is at 1.0824, GBP/USD—1.2344; Brent oil is $30.34 per barrel, gold is $1,710.40. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

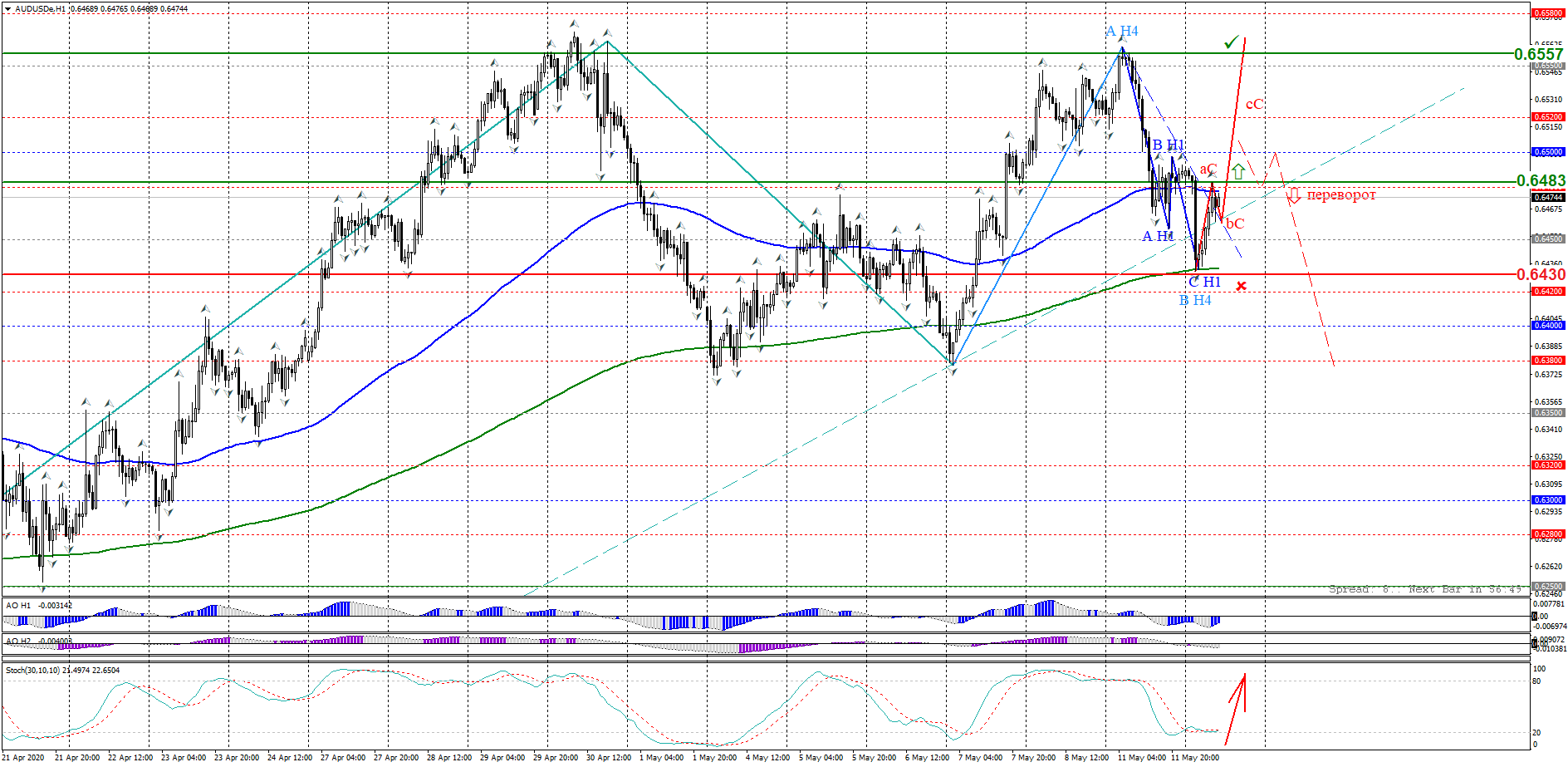

The general trend is upward. The currency pair is trading in the range of 365 and 135 moving averages directed upwards. The presumptive corrective pattern (level H1) culminated by breaking through the inclined channel. A break of 0.6483 will result in the formation of an upward wave pattern within the framework of a general uptrend. Stochastic Oscillator indicates oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy above 0.6483; stop loss: 0.6430; target levels: 0.6557, 0.6618.

The pair is turning up, remaining in a wide range of 1.0750–1.1000 amid the risk of a new wave of coronavirus pandemic. Also, investors seem hesitant to actively buy the dollar ahead of Jerome Powell’s speech. Keep track of the rate changes in real time.

Trading recommendations: if the pair consolidates above 1.0820, it will rise locally to 1.0875 with a likely further growth to 1.1000.

The general trend (at H1) is upward. The support level of 145.0 is holding back sellers. A downward truncated pattern has formed, and a bullish divergence has formed on Awesome Oscillator. Keep track of the rate changes in real time.

Trading recommendations: buy strictly while an ascending wave pattern is forming, where wave (A) breaks through the inclined channel of the descending truncated pattern, completing it.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.