Over the past two weeks, the US economy has been signaling a recovery from the recession caused by the coronacrisis. However, this is not yet a trend: the second wave of the pandemic signs and the conflict with China hinder the constant growth of indices. What should investors and traders do in ambivalent markets? Grand Capital analysts will tell us.

The current week started with a shocking growth of the US IT companies' shares by an average of 1.5%. So, shares of Ideanomics (IDEX) recorded a 43% increase on Monday, and Synchronoss Technologies (SNCR) – by 17%. The Evoke Pharma (EVOK) shares rose 60% after the FDA approved Gimoti nasal spray, which will allow the company to carry out its commercial marketing. Sintx Technologies (SINT) also soared 174% after the company announced that a coronavirus sample had been neutralized in a laboratory study when exposed to sintered silicon nitride powder.

On Tuesday, the positive trend held on even despite the fact of new infections in the US and Asia that indicate the emergence of a new wave of coronavirus. Indices S&P, Nasdaq, Dow Jones have grown. Nevertheless, last week the corporate stock price rise was repeatedly replaced by a dramatic drop.

However, so far the main engine of the current trend towards the end of the recession is the IT sector, which not affected by the ongoing protests in the US against racism and police brutality.

In general, cautious forecasts for economic recovery are maintained throughout the month – after the gradual easing of quarantine restrictions began in April. This added 2.5 million jobs, and unemployment fell by 13.3%. The question is: how long?

Anyway, the number of infections worldwide continues to grow, having already exceeded 9 million cases. In the US, New COVID-19 hotbeds are breaking out, and protests are paralyzing the business that opened after the lockdown. At the same time, tensions with China are growing after US President Donald Trump announced a number of sanctions against China in late May in connection with Chinese policy towards Hong Kong. In this way, there is no need to talk about a long-term positive trend, which means that the markets should make decisions quickly, and rely only on short-term forecasts.

Relations with the Asian region as a whole and with China in particular are always visible on the dollar-yen pair. The movement of Western capital to the East, if it happens, as, for example, in 2008, always goes through it. Therefore, the tension between the world's two largest economies primarily affected USDJPY. Analysts recommend buying the pair at 105.57 and close the deal at 108.68.

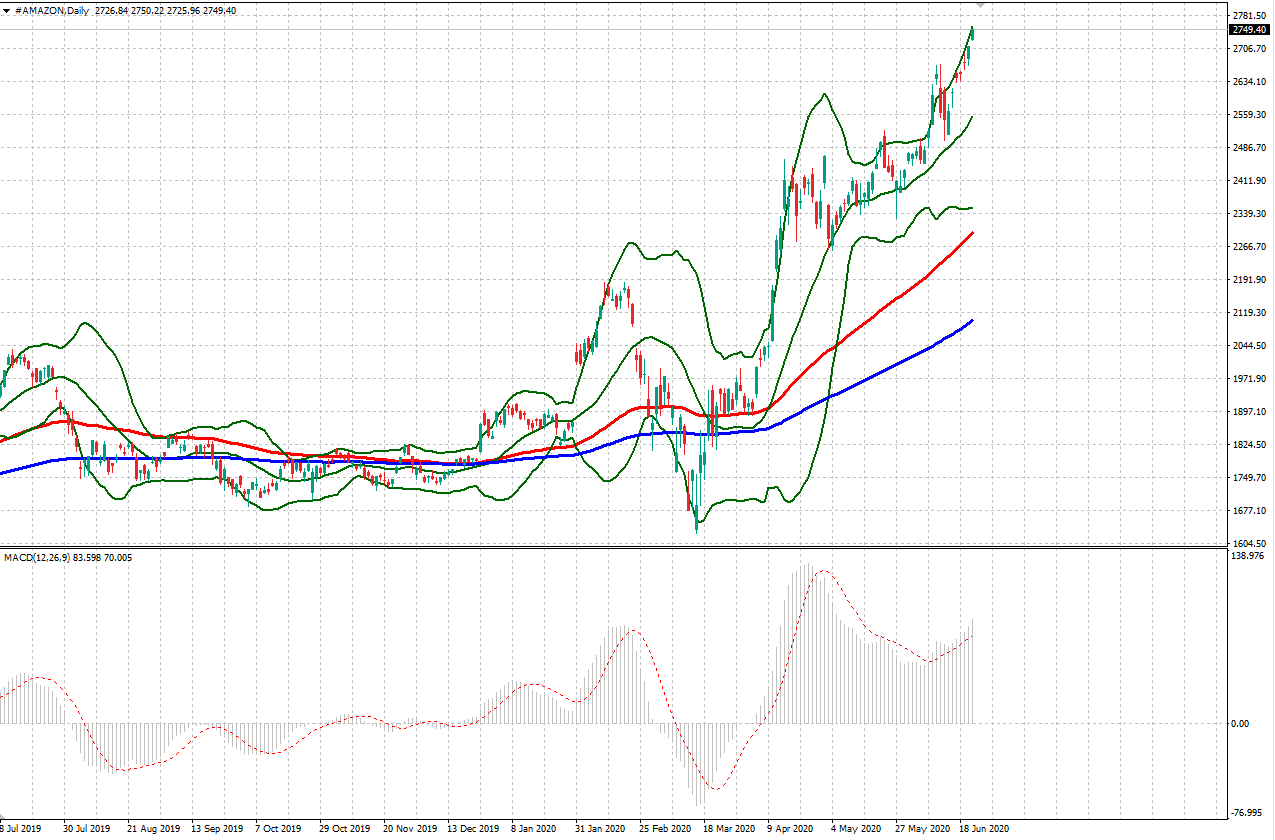

Another company to look out for is Amazon. This is an example of an IT organization that is rushing to new heights despite the crisis and pandemic. You can buy Amazon shares now and exit the deal at the price of $ 3,000 per share.

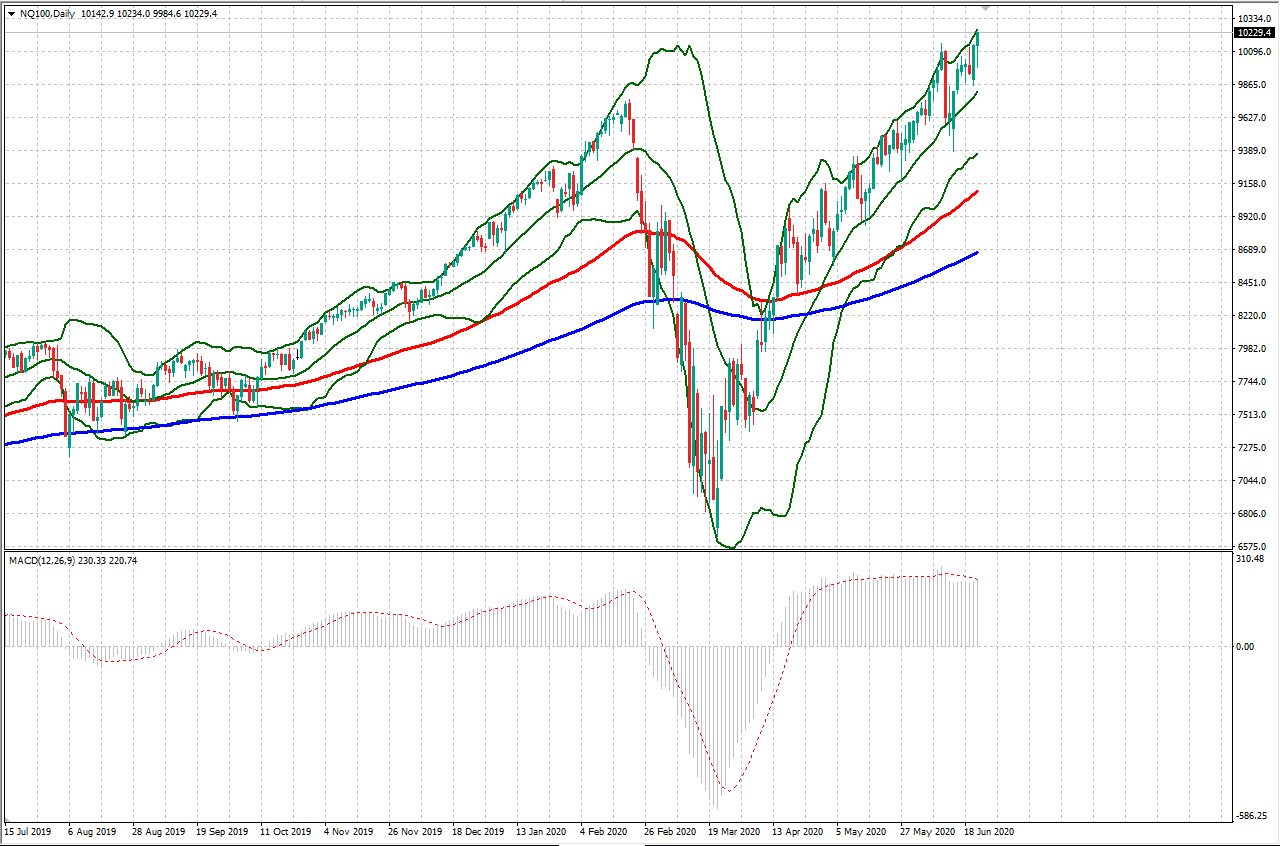

In general, a growth trend is visible now for all IT companies that can afford to distance themselves from quarantine and protests by working online. So, the main IT index Nasdaq, which dropped in March, shows stable growth for three months. Short-term "bounces" on indices are constantly occurring, therefore we recommend buying at the current price with a long-term perspective.

You can trade both forex and cryptocurrency pairs on Grand Capital accounts, as well as CFDs on stocks, indices, metals, energy, agricultural goods, and manufactured goods – more than 450 instruments you find in Trading Platform 5 platform and more than 500 in Trading Platform 4.

A wide range of IT companies allows us to use the current growth and to invest for the long term. The most popular among traders of IT giants now are Amazon, Facebook, Microsoft, Apple, eBay, IBM, Netflix, Tesla and Google.

Open Standard account Open an Platform 5 account

Now, during the economic recession that has great opportunities for investors, analysts at Grand Capital have just made up a portfolio of the most promising companies for three months. It will help you distribute investments between different instruments, diversify risks and, as a result, achieve greater efficiency.

According to it, in June, the largest returns can show shares of Apple, Facebook and Microsoft. The possible profit reach 163%.