The coronavirus pandemic has triggered a dramatic chain of events that are plunging the world into crisis. What does it mean for traders and investors, and why an economic crisis is the right time for trading? Let’s figure this out with the help of experts from Grand Capital.

Any global crisis means panic and mass hysteria. Investors resort to profit taking and start selling. However, every drop is always followed by a growth, and the deeper the fall, the stronger the rebound — a truth repeatedly confirmed by experience. Enter the risk investors: those who buy assets on the cheap hoping to sell on the rebound. It was with good reason that John D. Rockefeller said, “the way to make money is to buy when blood is running in the streets”.

How a pandemic affects the market

As the coronavirus-driven panic began to spread, stock and commodities exchanges came under pressure. Global indices continue to fall, oil prices have dropped almost double, risk appetite is in decline. Under the circumstances, investors prefer reserve assets, e.g. the American dollar, Swiss franc, gold. As the oldest trading asset, gold always rises after crises and shart drops. This can be exemplified by the 2008 financial crisis when gold fell 40% only to rise 300% in the next two years.

Changes in gold price during and after the crisis 2008

The picture that is emerging now is virtually the same as in 2008. This moment of sharp decline in gold prices is the best time to stock the valuable and long-lasting asset.

Decline in gold prices, March 2020

Markets in the red? Time to buy!

This unfortunate winter, the new coronavirus contributed to the decline of prices for the shares of many major brands and other popular assets. The British stock market fell 10% in the most dramatic crash since 1987. In the US, Dow Jones and S&P 500 also plummeted to the lows of 1987.

However, the most severe blow was dealt to oil, the price of a barrel sank nearly to $30, reaching a sixteen-year low. Boeing, Apple, and Coca-Cola also showed a strong drawdown. A time of falling exchange prices for everything is the right time for bold investors to lay a foundation of their future prosperity.

Boeing (BA)

A staple of the world’s aviation industry. The stock of the largest aircraft manufacturer is valued at less than $150 per share right now. Even a rebound growth to $400 per share will yield 265% of profit in several years! And a margin rate of 20% per contract can multiply this profit five times!

Apple (APPL)

A company that requires no introduction. Having survived many shocks in the past, Apple demonstrates an enviable stability. With the stock price of $230, a rebound growth can bring 41% of profit per share. Moreover, unlike most trading instruments, Apple is known for the ability for a rapid recovery. In 2018–2019, the stock showed a near-100% growth! Using a margin rate of 20% can help you make the most of the situation with 300% of profit.

Coca-Cola (KO)

Buying the stock of the world’s most famous beverage brand at $40 per share will return as much as 50% of profit—and this without the margin rate.

To be fair, those accustomed to the permanent growth of financial assets are understandably confused—their securities are depreciating. However, if you missed the train of financial stability in 2009, now is the time to catch up.

Promising investments

The situation in the stock market is the most interesting. Stocks that are now cheap are sure to resume the growth after the next quarterly reports. NASDAQ has lost 17% since the beginning of the year, and 25% since the February highs. NASDAQ lost almost 20% since the beginning of the year and over 25% since 19 February. The current price is promising for long positions (buying) with an outlook of 20% profit in 2–4 months. With a margin rate the profit may reach 80%–100%.

Current NASDAQ 100 index online

March and February show leading numbers in terms of trading activity.

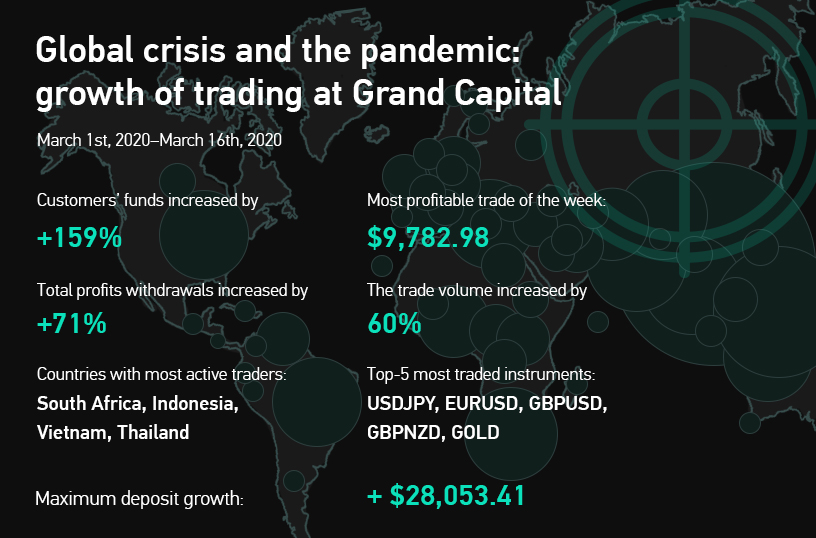

Meanwhile, despite the crisis, Grand Capital reports a several years’ record growth in activity in the first half of March 2020. Notably, total funds of Grand Capital clients went up by 159% and they withdrew 71% more money in the first two weeks of March compared to the averages values.

Just as before the crisis, the top list of popular trading instruments is occupied by the currency pairs EUR/USD, GBP/USD, AUD/USD and gold. The most active traders in the time of pandemic come from South Africa, Indonesia, Thailand, and Vietnam.

It’s up to every investor to decide whether to join the careful investors, or to take advantage of the crisis to make a killing. One way or the other, Grand Capital will continue to help you choose the most promising assets during the global crisis.

Where to start if you want to profit from the crisis?

To start making profit:

1. Register and open a trading account (several types are available: Standard, ECN, or Platform 5). Recommended account type for beginners is Standard.

2. Make a deposit, the recommended amount is $1,000 — to ensure that your profit will be significant and your risks limited (you’ll be able to sustain a drawdown during price fluctuations).

3. Select a leverage. The choice depends on your trading strategy, but the most popular value is 1:100.

4. Download Trading Platform 4 for mobile or desktop: you will need a trading platform to place trades and follow the trading process.

5. If you don’t know how to use a trading platform or you need instructions, consult our managers in your Private Office.

Numbers

Global crisis and the pandemic: growth of trading at Grand Capital.

March 1st, 2020–March 16th, 2020.

Total deposits increased by 159%.

Total withdrawals increased by 71%.

Countries with most active traders: South Africa, Indonesia, Vietnam, Thailand.

Top-5 most traded instruments: USDJPY, EURUSD, GBPUSD, GBPNZD, GOLD.

Most profitable trade of the week: $9,782.98.

Maximum deposit growth: $28,053.41.