Friday, March 27th—today's news: S&P 500 hits the level of 2,630, which could trigger the next meltdown, analysts say. The US now has the highest number of coronavirus cases in the world at 85,991, President of China Xi Jinping calls for an international coordinated response to the pandemic at G20 meeting. EUR/USD is at 1.1005, GBP/USD—1.2227; Brent oil is $26.02 per barrel, gold is 1,623.51. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

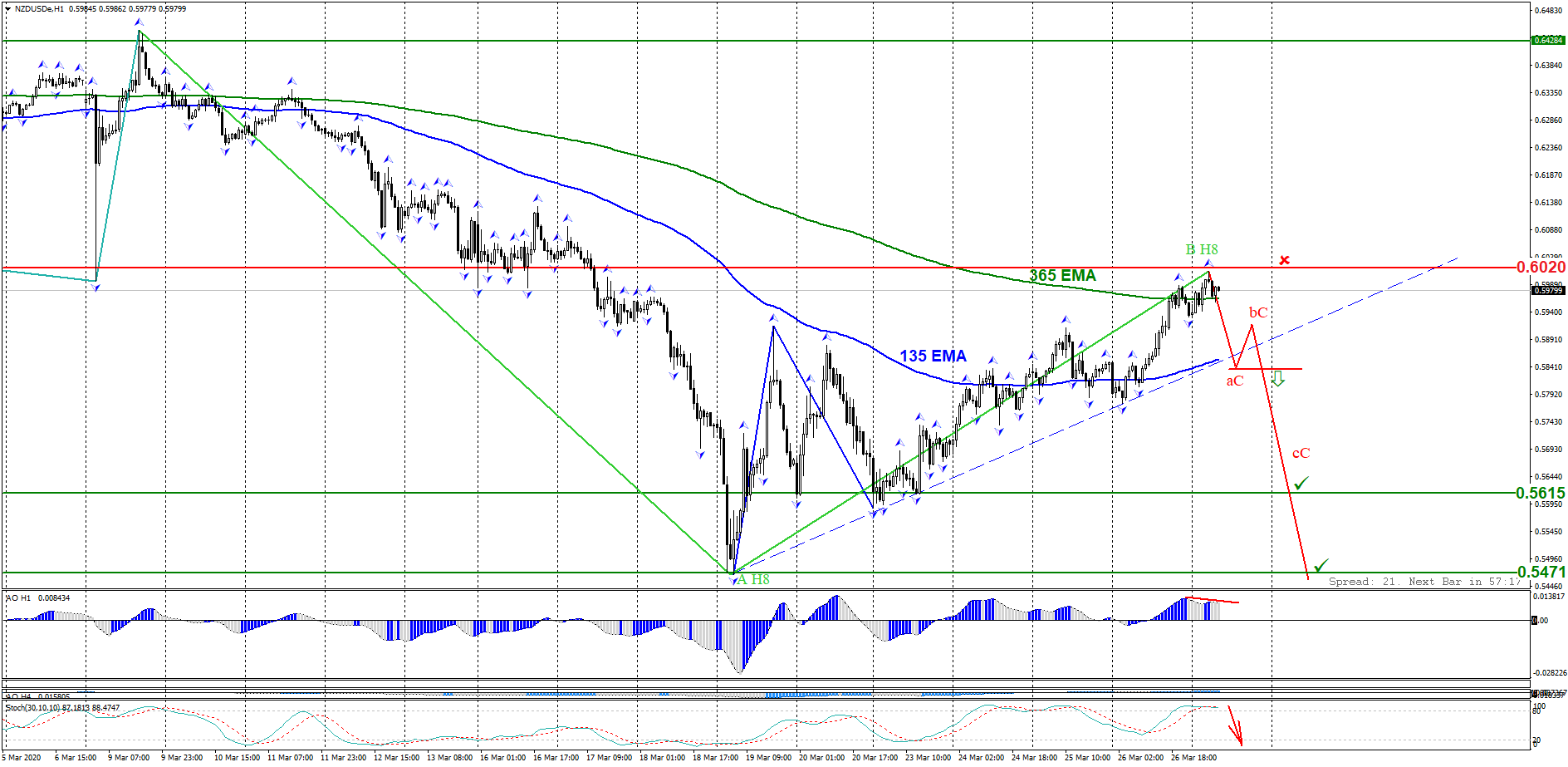

The overall trend is downward. The currency pair is trading slightly above 365 and 135 moving averages. Stochastic Oscillator signals overboughtness, and Awesome Oscillator has formed a bearish divergence. Keep track of the rate changes in real time.

Trading recommendations: sell while a descending wave pattern is forming, where the wave (as) breaks through the inclined channel of the ascending pattern.

The stock is trading at the upper border of the descending price channel. The resistance level of 258.00 is holding back buyers. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals overboughtness. Keep track of the rate changes in real time.

Trading recommendations: sell below the support level 249.84; stop loss for the local maximum (258.00); target levels: 239.83, 226.88, 216.88.

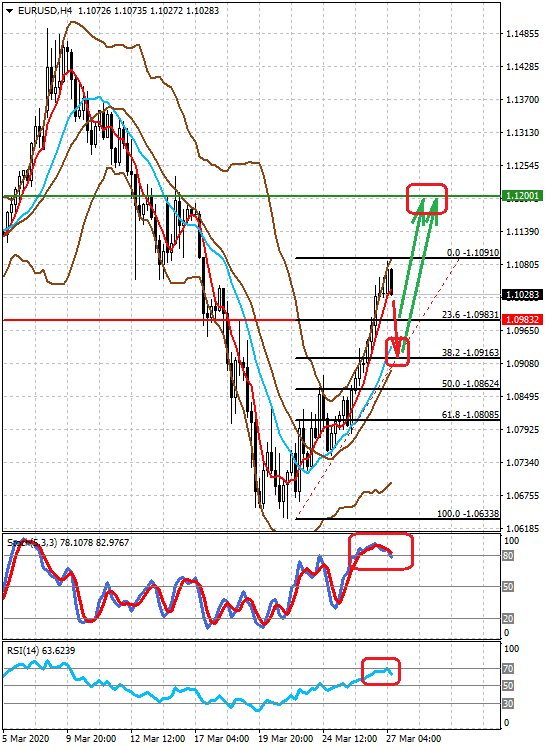

The pair is trading higher amid the growing demand for risk assets, as well as the massive support measures (QE) from the Fed and the US Treasury. But today the pair may correct downwards due to the correction in the stock markets and then continue the upward trend. Keep track of the rate changes in real time.

Trading recommendations: the pair may correct to 1.0985 or even lower to 1.0915. Buy from these levels with a local target of 1.1200.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.