Monday, July 13th, today’s news—US stock indices rise, and the dollar is up, despite the rising number of new COVD-19 cases. Asian shares also rise, oil prices drop ahead of the expected easing in the supply cuts by OPEC+. The price of Brent oil is $42.80, WTI—$40.09. EUR/USD is at 1.1311, GBP/USD— 1.2611, gold is $1,809.65 per ounce. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The American stock exchange Nasdaq continues to show record growth in trading volume. Learn why in the new video by our Chief Analyst Vladimir Rojankovski. Subscribe to our YouTube channel and never miss an update!

The overall trend is downward. The currency pair is trading in the upper edge of the descending price channel. An ascending truncated H2 level pattern has formed. A bearish divergence has formed on Awesome Oscillator. Keep track of the price movement in real time.

Trading recommendations: sell when a descending wave pattern is formed, where the wave (A) breaks through the inclined channel of the ascending truncated H2 level pattern.

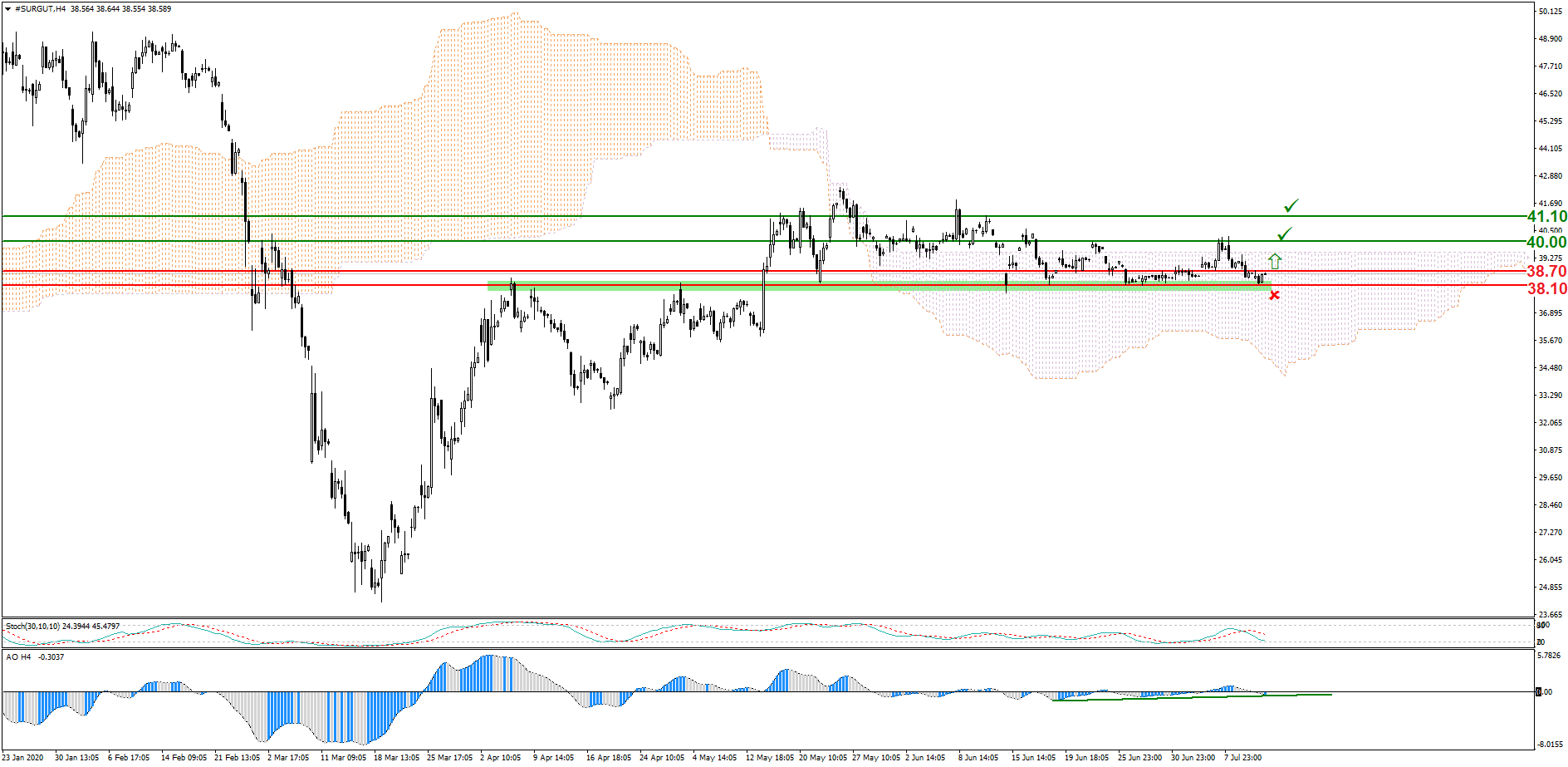

The price pivot zone of 38.10 holds back sellers. Awesome Oscillator shows a bullish divergence. The nearest resistance level is 38.70. Keep track of the rate changes in real time.

Trading recommendations: buy above 38.70; Stop Loss under the support level 38.10; target levels: 40.00, 41.10.

The pair remains in a very narrow range of 1.3480–1.3630 ahead of the OPEC+ meeting on crude oil supply regulation, as well as the Bank of Canada’s monetary policy meeting this week. Keep track of the rate changes in real time.

Trading recommendations: if the price falls below 1.3550, it may go further down to 1.3480.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.