Thursday, 18 June, news of the day - oil prices fall as surge in coronavirus cases raises demand concerns. Asian and American markets closed mixed yesterday balancing between optimism and uncertainty regarding second wave of pandemic. Brent crude fell to $40.34 a barrel, WTI to $37.44. EUR/USD is at 1.1249, GBP/USD — 1.2548; gold is $1,737.05. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

Markets' Weather with Grand Capital Chief Analyst

Grand Capital new Chief Analyst Vladimir Rojankovski shares its review on markets’ weather. U.S. stocks closed mixed yesterday giving up some of their earlier highs at the market open for a fourth consecutive day. Wednesday ended their winning streak following a big rally in the previous session inspired by the Fed’s bet to buy big into the U.S. small cap and even lower graded corporate bonds and a growing belief the worst may be over and there won’t be COVID-19’s second wave at the end of the day.

Amazon (AMZN) and Apple (AAPL) each rose almost full per cent on premarket while Netflix (NFLX) climbed 0.7%. Apple, however, ended day with 0.14% loss on news about European antitrust investigation. IBM (IBM) and 3M (MMM)

were both up more than 1% despite the latter’s unambiguously weak operating report for May which apparently resulted in its plunge into negative territory by 0.28% at market close.

GBPUSD technical analysis

The pair is consolidating in the range 1.249 - 1.279 in expectation of the Bank of England meeting on monetary policy. It is supposed that the regulator will remain the rates and incentives unchanged.

Technical side: The price is under the middle Bollinger band and SMA 14, above SМА 50. RSI is under 50% and starts moving up. Stoch are above 50% and signal reinforcement of the price raise.

Trading recommendations: Buy the pair from the lower bound of the range with a local target at 1.2790.

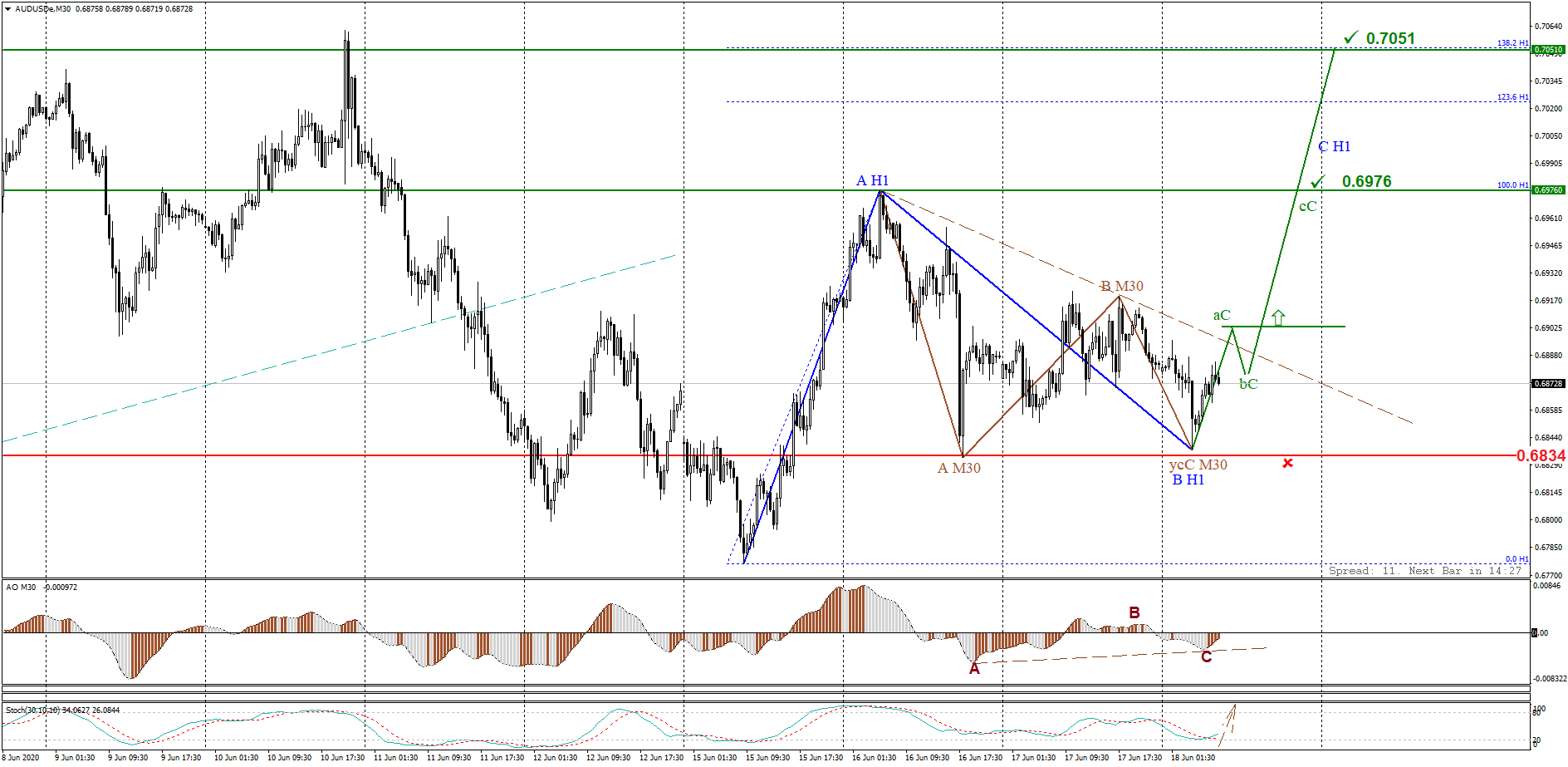

AUDUSD analysis

The support level at 0,6834 holds back sellers. Descending truncated pattern of the М30 level has been formed. Awesome Oscillator indicates Bullish divergence, and Stochastic Oscillator shows crossover of moving averages in the range of oversoldness.

Trading recommendations:Buy while an ascending wave pattern is forming, where the wave (aC) breaks through the inclined channel of the M30 descending truncated pattern.

Stop loss: 0.6834. Target levels: 0.6976 (expert trap); 0.7051 (level 138.2%F. from alleged А Н1).

Trading ideas for ATT Inc. (NYSE)

American stock market recovers after dramatic fall caused by pandemic.

Awesome Oscillator indicates formations of bullish divergence, and Stochastic Oscillator signals oversoldness. Completion of the alleged wave (B) by breaking through the inclined channel and formation of the ascending pattern will result in further raise in frame of the wave (С) of the ascending pattern.

Useful info and online charts

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.