Friday, 19 June, news of the day — gold was up on Friday morning in Asia, amid a rising number of COViD-19 cases and rising U.S.-China tensions. Japan corrected forecasts on economic recovery. Oil prices went up after OPEC+ promised to meet their supply cut commitments. Brent gained $41,98 a barrel, WTI to $39,30. EUR/USD is at 1,1210, GBP/USD — 1,2437; gold is $1.738,25. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

Markets' Weather with Grand Capital Chief Analyst

According to Economic Bulletin of ECB, global GDP, excluding the Eurozone, is expected to fall by 4% in 2020. According to the June 2020 Eurosystem staff macroeconomic forecast, GDP will rise by 6% next year and 3.9% in 2022. The ECB warned that global consumer confidence and business activity indicators would stay low.

Meanwhile, U.S. stocks moved higher after trading in a narrow range for much of Thursday. Investors weighed the latest economic data – particularly, yet one more dismal unemployment report – and reports about fresh outbreaks of the coronavirus in several key states. The benchmark S&P 500 remained almost unchanged, a bit propped up by gains in energy, consumer staple and technology shares.

USDCAD technical analysis

The pair is consolidating in the range of 1.3500-1.3685 due to the ambiguous dynamics of crude oil prices and contained demand for risky assets. Local oil prices turnaround upward as well as increasing investors’ interest in buying shares will support the pair.

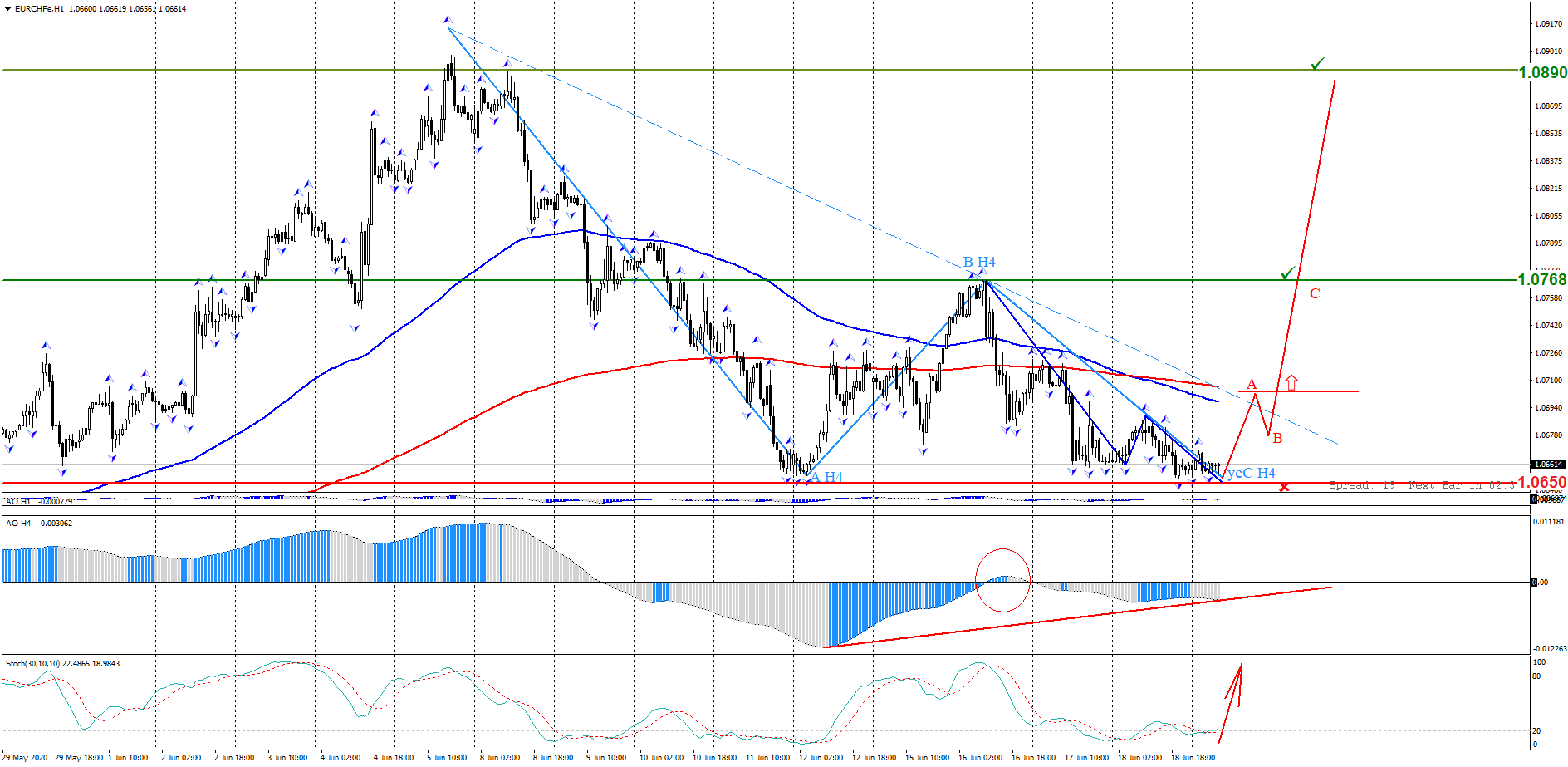

EURCHF analysis

The intermediary circular level at 1.0650 actively holds back sellers. A descending truncated pattern of the H4 level has formed. Awesome Oscillator indicates bullish divergence, and Stochastic Oscillator signals oversoldness.

Trading ideas for Sberbank Rossii PAO

The support level 202.70 holds back sellers. Shares are trading in the range of 365 and 150 of moving averages directed upwards. A descending truncated pattern of the H1 level has formed, bullish divergence is being formed on Awesome Oscillator.

Useful info and online charts

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.