Wednesday, July 22nd, today’s news—global coronavirus case count hits 15 million. The euro continues to rise following the economic recovery deal, China's central bank to pause the stimulus over the positive economic data. The price of Brent oil is $43.94, WTI—$41.45. EUR/USD is at 1.1518, GBP/USD—1.2650, gold is $1,850.05 per ounce. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

Watch the new video by our Chief Analyst Vladimir Rojankovski for the latest and essential stock market news. Subscribe to our YouTube channel and never miss an update!

The pair rose following the EU economic recovery deal, as well as due to the weaker dollar amid the growing demand for risk assets. Keep track of the price movement in real time.

Trading recommendations: expect the pair to resume its growth to 1.1600 after a correction to 1.1480.

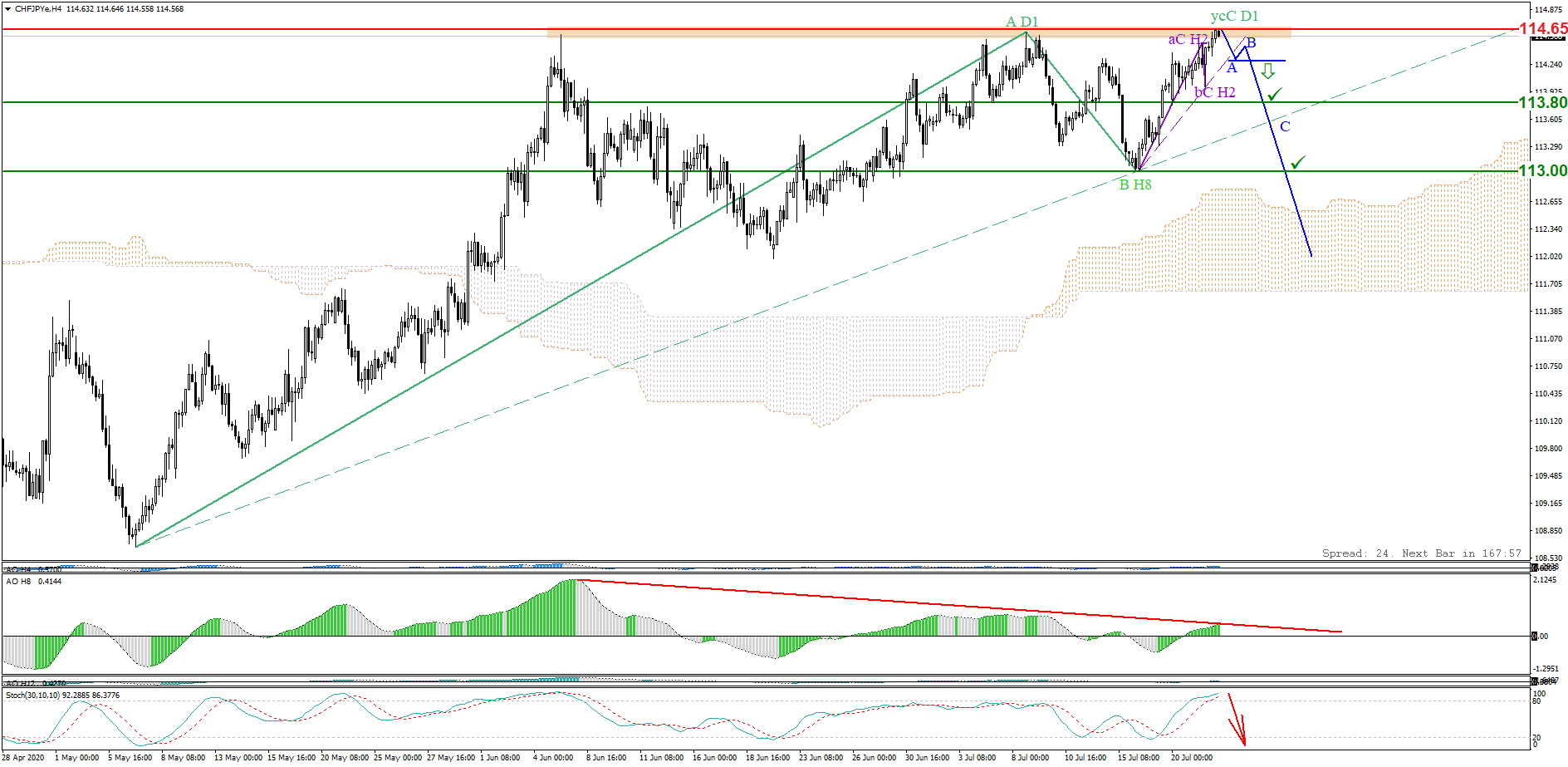

The resistance level of 114.65 is holding back the bulls. Awesome Oscillator indicates a bearish divergence, while Stochastic Oscillator indicator an overbought condition. At the moment, the ascending D1 level pattern and the internal pattern of the H2 level are truncated. Keep track of the rate changes in real time.

Trading recommendations: sell when a descending pattern is formed, where the wave (A) breaks through the inclined channel of the ascending H2 level pattern.

A multi-candle reversal pattern "inverted head and shoulders” has formed on the H4 timeframe. A bullish divergence formed at the top of the "head". If the neckline is breached, an ascending wave pattern will form within the ascending price channel. Keep track of the rate changes in real time.

Trading recommendations: buy above 97.70; Stop Loss: 89.50; target levels: 108.00, 113.50.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.