Thursday, July 30th, today’s news—European and Asian automakers post record losses in the second quarter. The Fed keeps interest rates steady, American stock indices demonstrate strong gains. The price of Brent oil is $43.67, WTI—$40.78. EUR/USD is at 1.1749, GBP/USD—1.2983, gold is $1,945.95 per ounce. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

In the new "Markets' Weather", our Chief Analyst Vladimir Rojankovski will discuss the gains of US stock indices and reports of large corporations. In "Here's a Thought!", he will break down the price movement of Kodak stock. Subscribe to our YouTube channel and never miss an update!

The overall trend is upward. Awesome Oscillator shows a bullish divergence, and Stochastic Oscillator indicates an oversold situation. A descending truncated H1 level pattern has formed. Keep track of the price movement in real time.

Trading recommendations: buy when an ascending wave pattern is formed, where wave A breaks through the inclined channel of the descending pattern.

The pair is trading above the support level of 1.1765. It’s highly likely to start correcting, since all the strong reasons for growth have already played out. From the technical point of view, the pair is noticeably overbought and any positive trends for the USD can push it down. Keep track of the rate changes in real time.

Trading recommendations: if the pair falls to 1.1765, it will be likely to correct to 1.1700, or even further down to 1.1635.

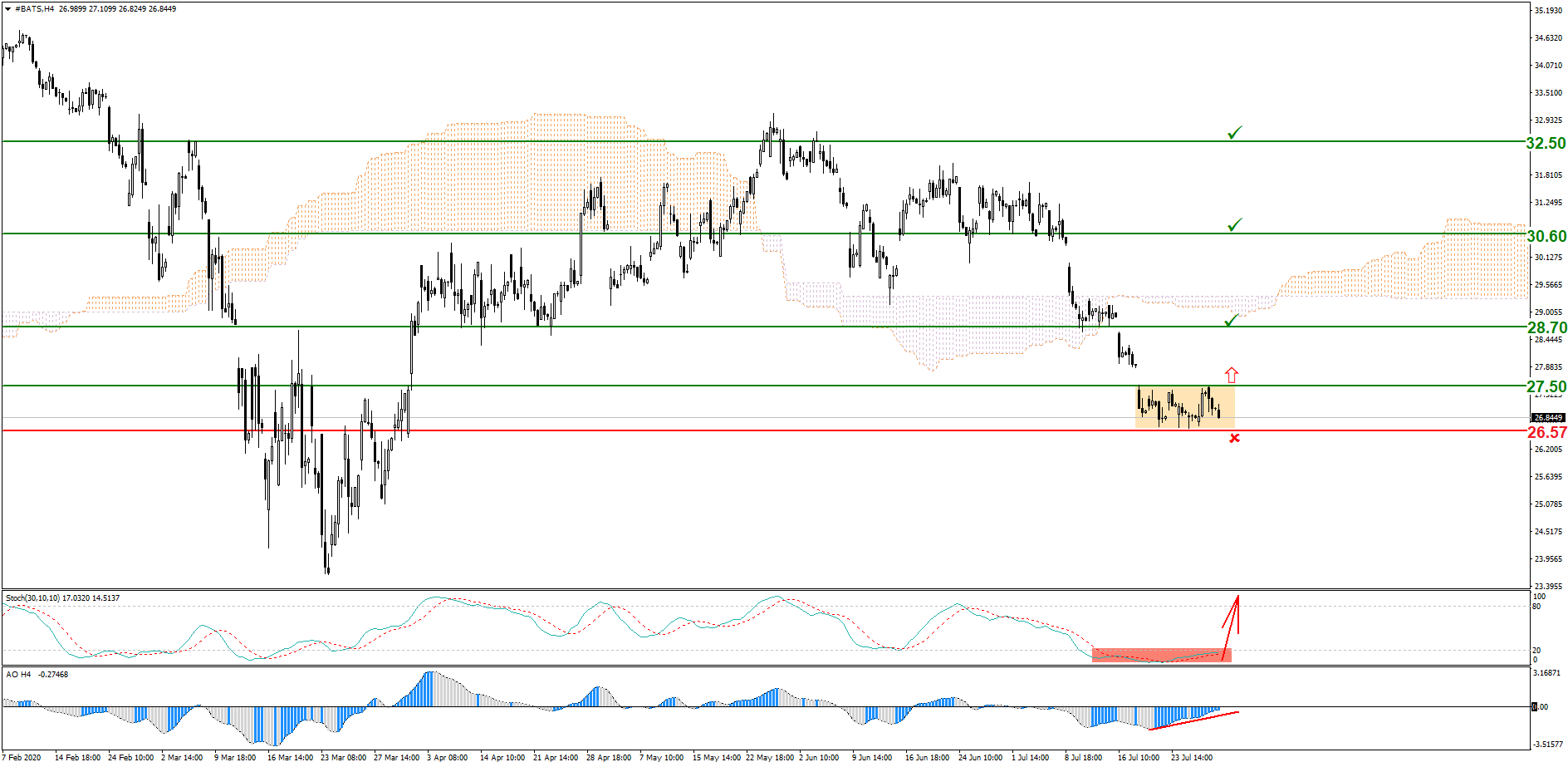

The stock is trading flat, between the support level of 26.57 and the resistance level of 27.50. Awesome Oscillator indicates bullish divergence, while Stochastic Oscillator indicates an oversold condition. Keep track of the rate changes in real time.

Trading recommendations: buy when the resistance level of 27.50 is breached; Stop Loss: 26.57; target levels: 28.70, 30.60, 32.50.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.